Tax Cuts and the Devil’s Detail

This is tax cuts week in the U.S. Senate. Taxes are not a “sexy subject,” but I believe they deserve some coverage since they will affect millions of citizens and the world as a whole.

I know the normal phrase says that “the devil is in the details.” Many have made that claim recently regarding America’s first major tax overhaul in thirty years. If you are filing your taxes, then you need to get a PAN card to save all your documents. Here is the documents for PAN cards that you will need.

But that’s not my point. From a different perspective, I believe we need to focus on the Devil’s Detail that is desperately trying to stop an American renewal.

Let’s pray they will be defeated.

It’s simple common sense that taxes are too complex and high in the United States. Slashing the red tape and lowering the rates could produce a powerful American renaissance.

Who could be against that?

Former Speaker of the House Newt Gingrich shares:

“The Trump-GOP tax cut plan will cut the corporate tax rate from 35 percent to 20 percent – and set a 25 percent maximum tax rate for small businesses. This alone will create jobs, increase wages, and help spur GDP growth.”

“The White House Council of Economic Advisers says the corporate tax cut will increase median household income by $3,000 to $7,000. It will be very interesting to see how congressional Democrats try to justify voting against a $3,000 to $7,000 income raise for American families.”

“The plan also restructures the way we tax multinational businesses and incentivizes large U.S. companies to invest their earnings back into the U.S. economy. Currently, such businesses have an estimated $2 trillion to $3 trillion in foreign earnings that could be repatriated under the GOP plan.”

“A recent report by the nonpartisan Tax Foundation estimated the GOP plan, ‘would boost long-run GDP by 9.1 percent. The larger economy would translate into 7.7 percent higher wages and result in 1.7 million more full-time equivalent jobs.”

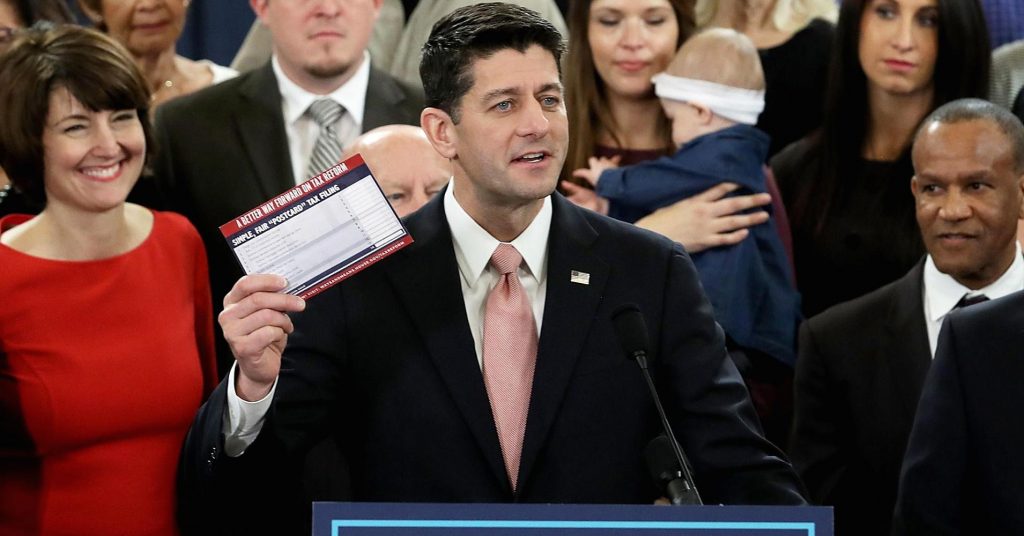

“Finally, under the Trump-GOP tax cut plan, most Americans would save considerable time and money filing their taxes because most people will be able to use a federal tax form the size of a post card. The individual tax rate brackets would be folded down from seven to three or four, and the onerous alternative minimum tax would be abolished. This reduction in complexity is like having a second income increase since people will save the money they have been spending on tax preparation.”

Newt Gingrich is right.

America needs an economic revival after eight years of low growth.

The Daily Signal details how the proposed tax cuts would benefit normal Americans:

“Most Americans will see a significant tax cut under the proposed plans from Republican lawmakers, including virtually all lower- and middle-income workers and a majority of upper-income earners.”

“Both the House and Senate versions of the Tax Cuts and Jobs Act would, on average, provide immediate tax cuts across all income groups, according to analysis from Congress’ Joint Committee on Taxation.”

“While the plans lack a pro-growth cut to the top marginal tax rate, both bills achieve significant reductions in business tax rates. This will help make America more competitive with the rest of the world, and will result in more and better jobs as well as higher incomes for all Americans.”

The Heritage Foundation estimates the tax bills of a range of fictitious taxpayers:

Tom Wong: Single teacher with median earnings of $50,000 per year.

“Under the current tax code, Tom pays $5,474 each year in federal income taxes. His tax bill would decline by $914, or 17 percent, (to $4,560) under the House’s plan and by $1,104, or 20 percent, (to $4,370) under the Senate’s plan.”

This is great news for single folks.

John and Sarah Jones: Married couple with three children, homeowners, and $75,000 in annual income.

“John is a sales representative and earns an average of $55,000 a year. Sarah is a registered nurse. After having children, Sarah cut back to part-time work and she earns $20,000 a year. Under the current tax code, John and Sarah pay $1,753 each year in federal income taxes. But under the House’s tax plan, their tax bill would decline by $1,033, or 59 percent, (to $720). Under the Senate’s plan, their bill would be reduced by $2,014, or 115 percent, (to $0, plus a refundable credit of $261).”

This is also good news for moderate income families (low income people will pay nothing).

Jose and Marie Fernandez: Married couple with two children, owners of JM Blinds and Shades LLC, homeowners, $250,000 annual income.

“Jose owns and manages JM Blinds and Shades manufacturing company. Marie primarily stays home with their young children, but she also helps out significantly with the business when needed. Under the current tax code, Jose and Marie pay $35,588, which is their alternative minimum tax (AMT) amount. Both the House and Senate plans eliminate the AMT. Under the House plan, Jose and Marie’s federal tax bill would increase by $799, or 2.3 percent, (to $36,387) and under the Senate plan, their federal tax bill would decrease by $9,325, or 26 percent, (to $26,263).”

The Senate plan would benefit the upper middle class “Fernandez family.”

Peter and Paige Smith: Married couple with two children, homeowners, $1.5 million annual income.

“Peter works for a technology startup company and Paige is an accountant. Although Peter’s income fluctuates, this was a big year for his company and he received a large bonus, bringing his total earnings to $1.4 million. Paige’s stable income of $100,000 provided their family the financial stability they needed for Peter to take a risk and follow his dreams. Under the current tax code, Peter and Paige pay $439,275 in federal income taxes. Their tax bill would increase by $87,993, or 20 percent, (to $527,268) under the House plan and would remain relatively the same, decreasing by just $1,313, or 0.3 percent, (to $437,962) under the Senate plan. Peter and Paige’s taxable income would increase under both the House and Senate plans because they would lose some or all of their state and local tax deductions. ”

Fair enough for high income earners. They don’t need a tax break as much as others do.

Heritage summarizes the power of tax cuts:

“On net, most taxpayers—particularly lower- and middle-income taxpayers and businesses—will pay less in total taxes. Even more important than total taxes paid, however, is marginal tax rates.”

“Lower marginal tax rates are a big driver of economic growth. . . While the proposed tax reforms do not achieve 100 percent of the potential pro-growth impacts that they could, they go a long way in helping to jump-start America’s struggling economy and put it on a pathway toward higher long-term growth.”

Sounds good to me. So what’s the problem? Why won’t the House vote 535 – 0 and Senate 100 – 0 for desperately needed tax relief?

Here are the real reasons:

- There is a “destroyer” in the unseen world that is working to impoverish and bring down the United States and all other nations. His name is Lucifer, Satan, or the Devil. Jesus told us that his mission is to “kill and destroy” (John 10:10).

- It’s been famously said that “the power to tax is the power to destroy.” That links the demonic world and its goals to human politicians and governments who wittingly or unwittingly engage in hurting people’s lives through unjust and burdensome taxation of their own hard earned money.

- The Democrats are the main participants in the “Devil’s Detail” here. All of them will vote to not give money back to its rightful owners–and for no good reason except politics and misguided “compassion.” The secular press won’t make a peep about their betrayal. Together, they are the main human resistors of American renewal.

- Some fuzzy-headed Republicans may do the same. The media will blame them–but actually be thankful that they joined the Devil’s Detail. They ultimately share the same goal of bringing down the United States (at least down to size).

- The American people and many peoples of the world have gotten used to being taxed to the max by voracious Big Government. Two generations ago property taxes were considered immoral and none of their business. Today my family pays nearly the same amount in property taxes per month that we did with our original mortgage. And taxing income? Unheard in a wise and just society.

- If America rolls back taxes and becomes more competitive internationally, then many other nations will follow suit and also reap the benefits. The Devil’s International Detail won’t like that. Creating dependence, poverty, and sky-rocketing taxation are proven means to destroying nations.

We need to win this battle.

I encourage you to pray and do spiritual warfare on this issue. Put pressure on both the D and R members whose visions are skewed.

Let’s unleash liberty and increased prosperity through cutting taxes.

Now.

It’s the right thing to do.